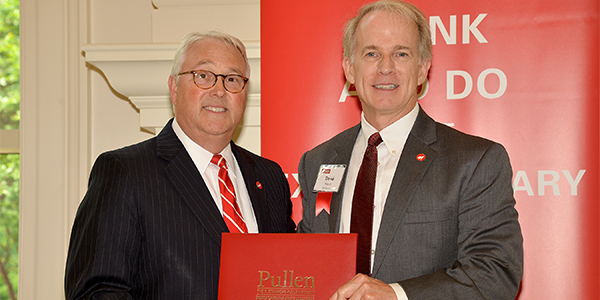

Real Estate Part Gift/Part Sale is a "Win-Win" For Donor

Randy attributes much of his success and good fortune to the degrees he earned from NC State: "My chemical engineering degree has provided me and my family with a comfortable and rewarding lifestyle."

Randy, his wife, Alice, and the couple's three children Clay, Rachel and George eventually settled in Greenville, South Carolina. For Randy, the Carolinas will "always be home," and he and his family often return to North Carolina to visit friends and family. Randy has also maintained close ties with NC State and the Department of Chemical Engineering. Randy served on the department's advisory board for 14 years, and says he has enjoyed watching the success and growth of the Department through the years: "My association with the advisory board has kept me close, and it has been exciting to be a part of the growth of the department and its transition to Centennial Campus."

In addition to his gifts of time and energy to shaping the future of the department, Randy also wanted to show his appreciation to NC State by making a financial contribution. Randy has made several cash gifts to the department over the years but always dreamed of making "a more lasting contribution in the form of a scholarship." He originally thought about including a bequest to NC State in his will, and then Randy had an opportunity to make his dream a reality while he was still alive. Randy owned a rental home in Charlotte, North Carolina. After the mortgage was paid off, he decided to sell the property and put the cash toward his retirement savings. Because he owned the property for some time, the capital gains taxes on the sale would have been significant. Still mulling over his options, Randy attended a presentation given by the Office of Gift Planning at NC State. One of the topics discussed was a charitable remainder trust or "CRT." A CRT allows a donor to transfer appreciated assets to a trust in exchange for an income stream for life. After speaking with the Office of Planned Giving, Randy went forward with a CRT for his rental property. The CRT allowed Randy to transfer the full value of the home without triggering current taxes. Randy retained an income stream from the trust for the rest of his and Alice's life, which they can enjoy in retirement. He also received an immediate charitable deduction for his gift, which will help offset income taxes on other earnings. After Randy and Alice pass away, the remaining trust assets will be used to fund a scholarship in the Department of Chemical Engineering.

For Randy, the CRT has been a "win-win situation." It has allowed him to minimize taxes, secure an income stream for retirement and also enjoy the benefits of giving back and seeing his dream of a scholarship realized during his lifetime.